As more organizations move to the cloud, one big challenge continues to rear its head: keeping financial control while scaling cloud infrastructure on the fly. What typically starts as a straightforward cost optimization exercise often evolves into a complex balancing act for cloud services between performance, innovation, and budget constraints.

Cloud financial management (CFM) is now a key focus for finance leaders working through today’s challenges. Unlike traditional IT budgeting, where costs were predictable and largely fixed, cloud environments operate differently. They introduce variable pricing models, on-demand scaling, and multi-service architectures that can make cost tracking feel like chasing a moving target.

Now, the stakes are much more significant. Organizations without proper cloud financial management frameworks often experience budget overruns, resource waste, and lost visibility into their largest technology investments. But with a structured CFM approach, you can cut costs while maintaining—or even improving—your high-quality service.

Quick answers: Cloud financial management

- What is cloud financial management (CFM)?

- Cloud financial management is the practice of tracking, governing, optimizing, and forecasting cloud spend so costs stay aligned with business value.

- What are the four pillars of cloud financial management?

- Visibility and analytics, governance and accountability, optimization and automation, and planning and forecasting.

- How is CFM different from FinOps?

- CFM is the broader discipline; FinOps is a collaborative operating model and set of practices within CFM that emphasizes cross-functional accountability and continuous optimization.

What are the four pillars of effective cloud financial management?

Successful cloud financial management rests on four fundamental pillars that work together to create sustainable cost optimization and governance frameworks.

Visibility and analytics forms the foundation, providing real-time insights into spending patterns, resource utilization, and cost allocation across teams and projects. Without full visibility, organizations can be left in the dark, making decisions with incomplete information. This leads to reactive cost management instead of the much more desirable proactive, strategic planning.

Governance and accountability establishes the policies, processes, and ownership structures that guide cloud spending decisions. This pillar makes cost optimization a shared responsibility across the team, not just a concern for finance. It does so by setting clear guidelines for resource provisioning, tagging, and approval workflows.

Optimization and automation focuses on putting tools and processes in place that continuously identify and act on cost-saving opportunities. This includes rightsizing resources, leveraging reserved instances, implementing autoscaling policies, and establishing automated responses to cost anomalies. Tools like Azure Advisor and GCP Recommender can help detect unusual spending patterns.

Planning and forecasting enables organizations to predict future cloud costs based on business growth, seasonal patterns, and planned initiatives. Accurate forecasting helps teams budget effectively and negotiate better contracts with cloud providers, while aligning technology investments with more specific business objectives.

What’s the difference between cloud financial management and FinOps?

Cloud financial management and FinOps are often used interchangeably, but they tackle different parts of the same challenge. Cloud financial management is the broader discipline covering all aspects of managing cloud costs, from strategic planning to tactical optimization. FinOps is a specific methodology within cloud financial management that focuses on collaboration between finance, operations, and engineering teams. It brings DevOps-style practices to financial management, focusing on automation, measurement, and iterative improvement.

Think of cloud financial management as the destination and FinOps as one proven path to get there. Organizations can implement effective cloud financial management through various approaches, but adopting FinOps principles has become particularly effective for companies seeking collaborative, data-driven cost optimization. FinOps includes frameworks like the three-phase lifecycle (Inform, Optimize, Operate), standardized metrics like unit economics and cost per service, and automated optimization practices that go beyond just team collaboration.

What cloud costs to monitor and pay attention to

Managing cloud finances effectively means knowing which costs have the biggest impact on your budget and operations. Not all cloud spending needs the same level of attention, and focusing on the right metrics helps teams prioritize their optimization efforts. Early-stage companies should focus primarily on compute costs, which typically represent 60%–80% of their bills, while more mature enterprises benefit from balancing compute optimization with storage lifecycle management and network architecture reviews.

Compute costs typically represent the largest portion of cloud bills, including virtual machines, containers, serverless functions, and specialized processing units. These costs fluctuate based on cloud usage patterns, instance types, and scaling behaviors, making them prime targets for optimization through rightsizing, scheduling, and reserved capacity strategies.

Storage costs, while often smaller in absolute terms, can grow unpredictably due to data retention policies, backup strategies, and inefficient data lifecycle management. Many organizations tend to overlook storage optimization, which leads to wasted resources like unused volumes, keeping backups too long, or choosing wrong storage classes.

Network and data transfer costs can surprise organizations, especially those with multi-region architectures or high data egress requirements. These costs tie directly to application design and can significantly impact the overall cost of running distributed systems.

Hidden or ancillary costs also deserve some dedicated attention—because teams easily overlook them, they accumulate rapidly. These include logging services charging per GB ingested, monitoring systems with per-metric pricing, security scanning tools, and managed databases that charge based on IOPS or connection counts.

5 steps for effective cloud financial management

Implementing cloud financial management takes a clear plan that tackles both technical and organizational challenges. These five steps provide a framework you can use to establish sustainable cost optimization practices in your organization.

1. Define clear objectives

Organizations need to establish clear, measurable objectives for their cloud financial management program before implementing any tools or processes. These objectives should align with broader business goals while addressing specific pain points in current cloud cost management practices. Cloud-native startups should prioritize unit economics and cost-per-customer metrics, while traditional enterprises benefit from focusing on budget variance reduction and cost allocation accuracy.

Effective objectives typically include specific cost reduction targets (such as achieving 15%–25% savings within the first year), alongside operational improvements (like reducing budget variance by 80% or achieving 95% cost allocation accuracy). However, objectives shouldn’t focus on cost reduction alone. Many organizations also target improved forecasting accuracy, faster decision-making cycles, and enhanced visibility into cloud spending patterns.

Teams should establish quantifiable and time-bound success metrics that allow them to measure progress and adjust strategies as needed. Establish both leading KPIs and lagging KPIs to get a complete picture of progress. Leading KPIs predict future performance, such as adopting tagging standards, completing rightsizing recommendations, or implementing automated policies. Lagging KPIs measure results after they occur, including actual cost savings, budget variance reduction, and improved cost allocation accuracy.

2. Assign cross-functional ownership

Cloud financial management succeeds when it becomes a shared responsibility across finance, operations, and engineering teams, rather than remaining siloed within any single department. This collaborative approach, often referred to as a cloud cost optimization culture, ensures that cost considerations become integrated into technical and business decisions.

Finance teams bring budgeting expertise, cost allocation knowledge, and business context to cloud financial management initiatives. From one of the highest levels, they understand how cloud costs impact overall financial performance and can establish appropriate governance frameworks and approval processes.

Operations and engineering teams have the technical knowledge about resource utilization, application architecture, and optimization opportunities. They know how cost optimization changes can affect performance and are assets for implementing technical solutions to handle it effectively.

Building cross-functional teams with clearly defined roles and responsibilities helps avoid accountability gaps and ensures cost optimization decisions consider both financial and technical needs. Regular communication between these teams, through weekly cost reviews or monthly optimization planning sessions, also helps maintain alignment and momentum.

3. Automate cost governance

Manual cost management processes don’t scale with cloud environments that can provision thousands of resources within minutes. Automation keeps costs in check while maintaining the flexibility that makes cloud computing so valuable.

Automated governance starts with implementing consistent tagging strategies through tag management tools like AWS Resource Groups, Azure Policy, or GCP Resource Manager. Tags should capture project information, cost centers, environment types, and ownership details, allowing organizations to track spending across multiple dimensions automatically.

Policy enforcement platforms prevent cost overruns by setting limits on resource provisioning, requiring approvals for expensive instance types, or automatically terminating resources after specified periods. Tools like AWS Organizations Service Control Policies, Azure Policy, and GCP Organization Policy balance cost management with operational flexibility by allowing standard operations to proceed while flagging unusual activities.

Anomaly detection systems identify cost anomalies, budget variances, and optimization opportunities in real time rather than reactively waiting for monthly budget reviews. Native tools like AWS Cost Anomaly Detection work alongside third-party platforms to trigger automated responses, such as scaling down resources during low-usage periods or sending notifications when spending exceeds predetermined thresholds.

4. Evaluate tools and integrations

While native cloud provider tools offer basic cost management capabilities, most organizations require additional tools to achieve comprehensive cloud financial management. The goal is to select tools that integrate well with existing systems and workflows while addressing specific gaps in current capabilities.

Native tools like AWS Cost Explorer, Google Cloud Billing, and Azure Cost Management provide foundational cost tracking and basic optimization recommendations. These tools work well for simple environments but often lack the advanced analytics, multicloud support, and workflow integration required for complex operations.

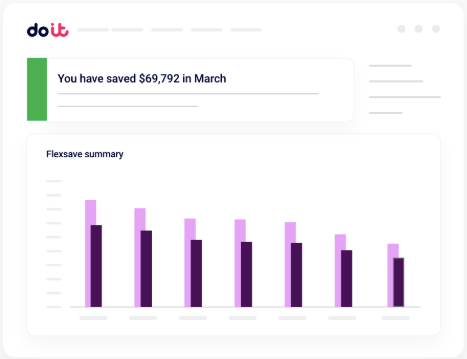

Third-party platforms like DoiT can provide enhanced analytics, automated optimization, and better integration with financial systems. Finance-led teams should prioritize ERP integration, detailed cost allocation, and executive dashboards, while engineering-led teams need API access, workload-level visibility, and integration with monitoring tools. Operations-focused teams benefit most from automation capabilities and workflow integration.

The evaluation process should include proof-of-concept testing with real workloads and data to validate tool effectiveness. Keep both short-term functionality and long-term scalability in mind to ensure the tools you choose can grow with your organization’s needs.

5. Track and refine metrics

Continuous improvement requires ongoing measurement and refinement of cloud financial management practices. Organizations should establish regular review cycles that assess both cost performance and process effectiveness.

Key performance indicators (KPIs) should cover multiple dimensions of cloud financial management, including cost trends, optimization success rates, budget accuracy, and process efficiency. Financial metrics might include cost per transaction, unit economics, or cost allocation accuracy. Meanwhile, operational metrics could track optimization recommendation implementation rates or time to resolve cost anomalies.

Regular reviews, whether during weekly operational sessions or monthly strategic assessments, provide opportunities to identify trends, celebrate successes, and address challenges. These reviews should include stakeholders from finance, operations, and engineering to maintain cross-functional alignment and be tied to forecasting refresh cycles.

The refinement process should also address both successes and failures, using data to understand what works and what needs to be improved. This iterative approach helps organizations continuously improve their cloud financial management maturity.

The core challenges in optimizing cloud spend

Even with the many available tools and best practices, organizations still struggle to get cloud spending under control. These challenges interconnect and compound each other, creating a progression that teams must understand to develop effective strategies.

- Complexity creates the foundation for problems. Today’s cloud environments span multiple providers, services, and pricing models, making it difficult to identify true costs, compare alternatives, and apply optimization strategies consistently. This complexity prevents teams from establishing baseline metrics for effective optimization.

- Tool fragmentation compounds the problem. Organizations accumulate multiple monitoring, optimization, and reporting tools over time to address complexity. This leads to “tool fatigue,” where teams spend more time reconciling conflicting data sources than optimizing costs. Data inconsistency across tools prevents effective decision-making.

- Cultural resistance emerges as a defensive response. Engineers push back on rightsizing recommendations they perceive as performance risks, while business teams view cost controls as impediments to innovation. Even well-researched optimization recommendations go unimplemented when teams resist changes that threaten perceived performance or agility.

The benefits of CFM done right

Organizations that successfully implement cloud financial management programs typically experience benefits that extend far beyond simple cost reduction.

Financial benefits include potential direct cost savings of 15%–25% in the first year, better budget predictability, and improved forecasting accuracy. This allows for better financial planning and reduces the risk of budget overruns that can impact other business initiatives.

The operational benefits include better visibility into cloud resource usage, quicker detection of performance issues, and smarter decisions about resource allocation. Teams gain a better understanding of which applications and services drive costs, allowing for more informed architectural and operational decisions that improve both performance and cost efficiency.

Strategic benefits enable faster market response. Teams can evaluate new services and scale initiatives with confidence in cost implications, reducing time-to-market for new features. Organizations with mature CFM practices make faster, more confident decisions about cloud adoption and optimization strategies.

How to leverage CFM tools to reduce costs

Effective cloud financial management relies on selecting and implementing the right combination of tools that address specific organizational needs and technical requirements.

Multicloud visibility

Managing costs across multiple cloud providers requires tools that can aggregate data, normalize metrics, and provide unified views of spending patterns. These tools should handle different pricing models, service categories, and billing cycles while maintaining accuracy and timeliness. Plainsight leveraged this capability with DoiT to gain clear visibility across their AWS and GCP environments, enabling accurate cost comparisons that were previously impossible.

Multicloud visibility tools typically integrate with cloud provider APIs to collect detailed usage and cost data. They then apply normalization, converting different providers’ billing data into standardized formats so AWS EC2 hours, Azure VM hours, and GCP Compute Engine hours can be compared on equivalent resource specifications rather than raw hours alone. However, normalization logic varies significantly across tools, with some platforms offering stronger support for AWS than GCP, or better Azure integration than other providers. When evaluating multicloud tools, consider how well they handle the specific cloud providers in your environment and whether their normalization approach aligns with your reporting needs.

Real-time budget forecasting

Traditional annual budgeting processes don’t align well with dynamic cloud environments where usage can vary significantly based on business cycles, customer behavior, and technical changes. Real-time forecasting tools like DoiT use historical data, trend analysis, and business context to provide more accurate short-term and medium-term cost projections.

These tools should integrate with your established business metrics and planning systems to help you understand how changes in customer growth, seasonal patterns, or product launches might impact cloud costs.

Actionable cost optimization

The most sophisticated cloud cost optimization tools go beyond identifying opportunities, either implementing optimizations automatically or offering detailed implementation guidance. Carto leveraged this approach with DoiT to scale their growth-focused strategy while maintaining strict cost controls across multiple cloud environments.

Actionable optimization means offering tailored rightsizing suggestions with specific instance recommendations, analyzing reserved capacity with clear purchase advice, and using automated policies to stop waste before it happens. However, effective automation must be governance-aware, respecting organizational policies and business constraints. For example, resources tagged as “production critical” automatically receive exemption from rightsizing, while “development” resources stop automatically outside business hours based on team schedules. Policy-based automation prevents optimization actions that might impact compliance requirements or service-level agreements, ensuring cost savings never compromise operational integrity.

Start reaping the rewards of a strong cloud financial management strategy

Cloud financial management has evolved from a nice-to-have capability to a business-critical discipline that directly impacts organizational competitiveness and financial performance. The organizations that invest in comprehensive CFM practices today will be better positioned to leverage cloud technologies strategically while maintaining financial discipline.

Success requires more than just implementing tools. Now, it demands cultural change, cross-functional collaboration, and continuous improvement mindsets. However, the business value benefits—significant cost savings, improved operational efficiency, and enhanced business agility—certainly justify the investment.

Take control of your cloud costs by grabbing our free guide to understanding and optimizing your public cloud costs.

Cloud financial management FAQs

What is cloud financial management (CFM)?

Cloud financial management is the practice of tracking, governing, optimizing, and forecasting cloud spend so costs stay aligned with business value. It combines financial controls with operational visibility to reduce waste, improve predictability, and support better investment decisions.

What are the four pillars of cloud financial management?

The four pillars are visibility and analytics, governance and accountability, optimization and automation, and planning and forecasting. Together, they provide the data, controls, and operating rhythm needed to manage cloud spend sustainably.

What’s the difference between cloud financial management and FinOps?

Cloud financial management is the broader discipline for managing cloud costs end-to-end. FinOps is a specific operating model within CFM that emphasizes shared accountability across finance, engineering, and business teams, with continuous measurement and optimization.

What metrics should we track to measure CFM success?

Track a mix of financial and operational KPIs such as budget variance, forecast accuracy, cost allocation accuracy, unit costs (e.g., cost per customer/transaction), optimization implementation rate, time to detect anomalies, and cloud spend trends by team/service.

What’s the fastest way to get started with cloud financial management?

Start with objectives (what you’re trying to improve), enforce tagging/cost allocation basics, set up anomaly alerts and budget guardrails, establish a review cadence with finance and engineering, and then layer in automation and forecasting as maturity grows.