What Is Cloud Financial Planning? A Strategic Guide for FinOps Leaders

Cloud financial planning extends well beyond traditional IT budgeting into a much more dynamic discipline where resources are provisioned in minutes and costs fluctuate with actual usage. Finance leaders balance financial stability with operational flexibility while aiming to align cloud investments with the company's business goals. Organizations mastering this discipline can achieve up to 30% cost reductions while maintaining performance, according to the FinOps Foundation, while those without solid planning strategies risk budget overruns and missed growth opportunities.

The shift to cloud-based financial operations: from CapEx to OpEx models

The transition from capital expenditure (CapEx) to operational expenditure (OpEx) models is one of the most fundamental changes in IT financial management in decades. Traditional CapEx models meant big up-front costs for hardware, software licenses, and infrastructure, with depreciation spread out over three to five years. Finance teams could plan expenses fairly predictably, and capacity planning typically ran on annual or multi-year timelines.

Cloud computing inverts this model entirely. OpEx-based cloud consumption introduces variable costs that scale directly with business activity, creating both opportunities and challenges for financial planning. The immediate benefit is capital efficiency. This means organizations can deploy resources without large up-front investments and scale capacity in real time based on demand. However, while OpEx models improve capital efficiency, they can create significant volatility in cost profiles, especially when workloads lack cost-awareness or proper autoscaling boundaries.

The impact goes beyond just accounting labels. OpEx models allow for what’s known as “just-in-time capacity provisioning,” meaning infrastructure costs can better align with revenue as it comes in. A retail company, for example, can automatically scale compute resources during peak shopping periods and scale down during slower months, optimizing both performance and costs. This kind of flexibility wasn’t possible with traditional CapEx models, where organizations often kept extra capacity just to manage peak loads.

However, the shift also introduces new financial risks. Without proper governance, the ease of resource provisioning can lead to “cloud sprawl,” where teams spin up resources that remain underutilized or forgotten. The fluctuating nature of OpEx costs can make budgeting tricky, especially for organizations going through rapid growth or dealing with seasonal changes.

To mitigate these risks, organizations should use cloud provider tools or third-party platforms to automate resource lifecycle management and shut down resources after periods of inactivity. This reduces manual overhead while ensuring cloud spend aligns with actual business needs. Scheduling monthly or quarterly resource reviews also helps identify and decommission unused instances, preventing cloud sprawl and wasted spend.

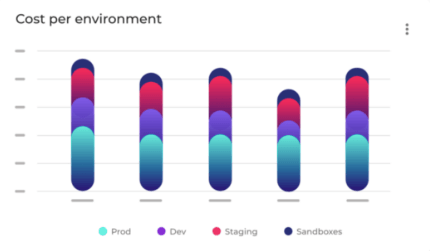

Finance leaders can get more value out of their business by tracking cloud costs and linking them to specific business units or projects. With tagging and dashboards, it’s easier to see how those investments connect to revenue and key strategies.

Cloud financial planning: What are its top challenges?

Cloud financial planning faces three primary challenges that distinguish it from traditional IT financial management.

Unpredictable and variable cloud costs are the most immediate challenge for finance teams accustomed to fixed monthly infrastructure expenses. Cloud costs fluctuate based on numerous factors including traffic patterns, application performance, data transfer volumes, and storage growth. A seemingly minor application change can trigger cascading cost increases across multiple services, while performance optimizations can yield unexpected savings. This variability makes traditional yearly budgeting methods a poor fit for cloud environments.

The challenge intensifies with autoscaling configurations, where infrastructure automatically adjusts to demand. Autoscaling prevents performance degradation during traffic spikes, but it can also lead to unexpected cost increases if not properly configured with cost guardrails. Organizations frequently discover that their “cost-optimized” autoscaling policies actually end up increasing spend during normal operations due to overly aggressive scaling thresholds.

Pro tip: To maintain control, organizations should set up automated cost alerts and regularly review autoscaling policies to ensure spending stays on track.

Lack of visibility into cloud expenditures makes cost fluctuations even harder to manage. Cloud providers give you plenty of billing data, but it often misses the business context you need to make smarter, informed decisions. For example, a finance team might see $50,000 in monthly compute costs but have no way to determine whether that's supporting the customer-facing web application generating revenue or a forgotten analytics environment from a completed project.

The issue goes beyond just figuring out costs. Without a clear view of how resources are being used, organizations miss out on chances to optimize and struggle to make smart decisions about resource sizing. Addressing this challenge requires implementing consistent resource tagging standards and using dashboards to visualize spend by project or business unit. This visibility is core to the “Inform” phase in FinOps methodology, providing more accountability across teams and supporting better decision-making by connecting cloud costs directly to business outcomes and strategic priorities.

Pro tip: Implementing consistent resource tagging and using dashboards to visualize spend by project or business unit helps finance leaders quickly allocate costs and spot inefficiencies.

Difficulties aligning cloud investments with business objectives create the most strategic challenge for cloud financial planning. Traditional IT investments could be evaluated using standard ROI calculations and compared against alternative uses of capital. Cloud investments, however, often deliver value through improved operational efficiency, faster time-to-market, or enhanced customer experience. These benefits are difficult to quantify using traditional financial metrics.

This alignment challenge is especially tricky when it comes to advanced cloud services. For example, organizations might move to managed database services for easier operations but find it hard to measure the cost savings from less admin work. Similarly, adopting cloud-native architectures could mean higher short-term costs, even though they offer long-term scalability that doesn’t always fit neatly into annual planning cycles.

To address this challenge, establish regular cross-functional reviews that explicitly map cloud spend to key business initiatives and KPIs. This requires developing governance frameworks that consistently evaluate cloud investments against measurable business outcomes, such as revenue impact, customer satisfaction scores, or operational efficiency gains. By linking cloud expenditures directly to strategic objectives through structured governance processes, finance leaders can better justify investments and optimize resource allocation for maximum business value.

6 effective strategies for cloud financial planning

Accurate cloud financial planning requires a strategic approach to balance cost optimization with business growth objectives. Here are seven effective strategies to help organizations effectively plan and manage their cloud costs.

Establish clear budgeting processes

Effective cloud budgeting means moving beyond traditional annual allocation models toward dynamic budgeting frameworks that can adapt to changing business needs. Cloud budgeting operates on multiple time horizons simultaneously: annual strategic planning for major initiatives, quarterly adjustments based on business performance, and monthly operational budgets that reflect actual consumption patterns.

Successful organizations use rolling forecast models that update budget projections based on recent consumption trends and planned business changes. Using cloud cost management tools, these forecasts are updated monthly with actual usage data and anticipated business developments. These models incorporate both bottom-up resource planning (based on application requirements and growth projections) and top-down business constraints (based on revenue forecasts and strategic priorities). This dual approach helps ensure cloud budgets remain both technically realistic and financially responsible.

Budget allocation strategies should reflect the different cost characteristics of various cloud services. Compute and storage costs typically scale predictably with usage, while networking and data transfer costs can be more volatile. Advanced cloud budgeting frameworks break down different cost categories and use the right forecasting models for each one.

Optimize resource utilization and rightsize resources

Resource optimization in cloud environments requires continuous monitoring and adjustment rather than periodic capacity-planning exercises. Effective rightsizing strategies analyze utilization patterns across multiple dimensions including CPU, memory, storage IOPS, and network bandwidth to identify optimization opportunities.

The challenge lies in balancing cost optimization with performance requirements. Downsizing instances based on average CPU use can degrade application performance during peak periods. Conversely, maintaining oversized instances for peak capacity wastes resources during normal operations. Better optimization approaches use predictive analytics to identify resources that can be safely downsized and implement automated scheduling to scale resources based on known usage patterns. Set up automated reports to flag overprovisioned resources, then schedule monthly reviews with engineering teams to validate and adjust instance sizes.

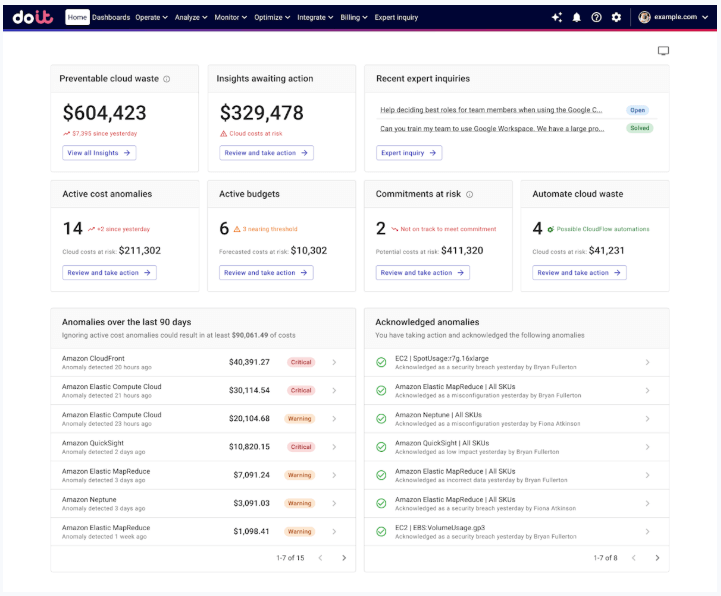

Advanced optimization strategies also consider the intent behind workload design. DoiT Cloud Intelligence goes beyond “find the idle server” approaches by mapping every dollar to the intent of the workload it funds, like latency targets, fail-over guarantees, and developer velocity. With full-stack data tracking and workload-specific expertise, you can tackle design waste first, adjust resources second, and save money—all without compromising the speed, uptime, or security your customers rely on.

Conduct regular billing and usage reviews

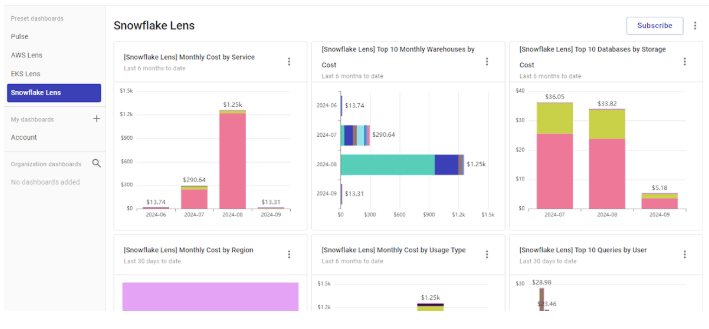

Systematic billing analysis reveals optimization opportunities that are often invisible in day-to-day operations. Effective reviews look at cost trends from different angles, such as services, regions, business units, and time periods. These reviews should identify both sudden cost spikes that require immediate attention and gradual cost increases that might indicate resource sprawl or inefficient scaling policies.

Beyond traditional monthly billing reports, cloud financial management requires real-time monitoring capabilities. Implement daily cost alerts with thresholds set at 10-15% above normal spending to catch anomalies early, as costs can change rapidly based on application behavior and business demand.

Hold monthly billing reviews focused on operational optimization opportunities and unexpected cost spikes. Quarterly reviews should examine strategic questions about service selection, architectural decisions, and long-term trends. Annual reviews provide opportunities to evaluate whether cloud investments are delivering expected business value and to adjust long-term financial planning accordingly.

The goal of effective billing reviews is looking beyond surface-level metrics like high CPU, IOPS, or GPU utilization to uncover hidden inefficiencies in cloud workloads. The most valuable monitoring approaches integrate financial data with operational metrics to provide clear visibility into cloud performance and costs, allowing for more informed decisions about performance versus cost trade-offs. What may appear as “fully utilized” infrastructure often masks waste, like skewed data processing in Spark clusters, unindexed database queries, or underutilized GPU inference workloads. DoiT Cloud Intelligence helps organizations pinpoint workload-level optimizations that drive bigger savings and performance gains than simple instance rightsizing.

Leverage reserved instances and savings plans

Strategic commitment-based purchasing requires balancing cost savings with operational flexibility. Reserved instances and savings plans can deliver substantial cost reductions—up to 72% in AWS, 80% with Azure Reserved VM Instances, and significant savings through Google Cloud Committed Use Discounts—but require accurate capacity forecasting and long-term commitment to specific resource types or spending levels.

The most effective organizations develop tiered commitment strategies that purchase reserved capacity for baseline workloads while maintaining flexibility for variable demand through on-demand and spot instances. This approach relies on advanced forecasting models to pinpoint which workloads are genuinely predictable. It separates them from those driven by seasonal changes or growth needs. By analyzing historical usage patterns, organizations can identify workloads suitable for reserved capacity and use provider calculators to estimate savings before committing.

Commitment strategies should also consider the operational overhead of managing different pricing models across cloud providers. While spot instances (AWS), preemptible instances (Google Cloud), and spot VMs (Azure) offer the lowest costs, they require application architectures that can handle instance interruptions. Organizations should evaluate whether the engineering effort required to implement interruption-tolerant architectures justifies the cost savings across their multi-cloud environments.

Set up governance frameworks for cloud usage

Cloud governance frameworks should balance cost control with operational agility. Overly restrictive policies can prevent teams from leveraging cloud capabilities effectively, but insufficient controls can lead to uncontrolled spending and resource sprawl.

Ideally, governance should combine automated policies with human oversight. Automated policies can enforce basic cost controls like instance size limits, automatic resource tagging, and idle resource detection. Human oversight focuses on strategic decisions about service selection, architectural patterns, and investment priorities.

The most successful governance frameworks also include establishing a cloud cost optimization culture that makes cost awareness part of daily operations rather than a separate financial exercise. Get started by conducting quarterly cost optimization workshops with development teams to build cloud economics awareness and creating incentive structures that reward both innovation and cost efficiency.

Take advantage of provider discounts and credits

Cloud providers offer numerous discount programs beyond standard reserved instance pricing, but these programs often require active management and strategic planning to maximize the actual value. Enterprise discount programs, volume commitments, and credit programs can significantly reduce cloud costs for organizations that understand how to navigate these offerings effectively. Create a centralized tracking system to monitor all active discounts, expiration dates, and utilization rates to ensure maximum value.

Many organizations miss opportunities for additional savings through partner programs and third-party marketplace purchases. Working with cloud partners can provide access to enhanced discount programs and specialized FinOps tools for cloud cost optimization that aren’t available through direct provider relationships.

Timing your purchases and commitments strategically can help you get the most out of discounts. By syncing renewals with your business cycles and combining purchases across different teams or projects, organizations can negotiate better deals and make smarter use of their budget.

What are the four pillars of cloud financial management?

Cloud financial planning operates within the broader framework of cloud financial management. This includes four connected pillars that work together to make the most of cloud investments.

Measurement and accountability establishes the foundation for all other financial management activities. This pillar focuses on implementing accurate cost allocation, chargeback systems, and financial reporting that provides visibility into cloud spending patterns. Without reliable measurement systems, organizations can’t make informed decisions about optimization priorities or evaluate the success of cost management initiatives.

Cost optimization is the tactical execution of financial efficiency improvements. This includes rightsizing resources, eliminating waste, leveraging discount programs, and implementing automated cost controls. Cost optimization should be an ongoing effort, not just something you do once in a while, including adopting FinOps practices that make optimization part of daily operations.

Planning and forecasting provide the strategic framework for cloud financial management. This pillar brings budgeting, capacity planning, and investment evaluation activities together to allow organizations to align cloud investments with business objectives while maintaining financial predictability.

Finally, cloud financial operations integrates financial management into cloud operations workflows. This includes implementing governance policies, training development teams on cloud economics, and motivating engineering teams to consider cost implications in their technical decisions. Financial operations help make cost awareness a part of the organization’s culture instead of just being a task for the finance team.

Master both cloud financial planning and overall management

Successful cloud financial planning requires integrating financial discipline with operational agility. Organizations that treat cloud financial planning as a purely financial exercise often struggle to achieve their cost optimization goals. On the other hand, those that ignore financial planning in favor of pure technical optimization miss out on opportunities for strategic value creation.

The most successful approach combines rigorous financial planning with sophisticated technical optimization. This requires close collaboration between finance, engineering, and operations teams to develop planning processes that support both financial predictability and technical innovation. Of course, it’s easier said than done, but the complexity of this challenge also creates opportunities for organizations to differentiate themselves through superior cloud financial management capabilities.

Grab our guide to getting a clear picture of your cloud costs. It’ll help you allocate your resources strategically and build a foundation for sustained financial success in the cloud.