FinOps Strategy: A Step-By-Step Guide to Creating Yours

Cloud adoption’s rapid rise has transformed organizational finances, replacing predictable infrastructure costs with fluctuating spending based on usage and architecture choices. This exposes the shortcomings of traditional financial controls that stick to fixed budgets and static line items.

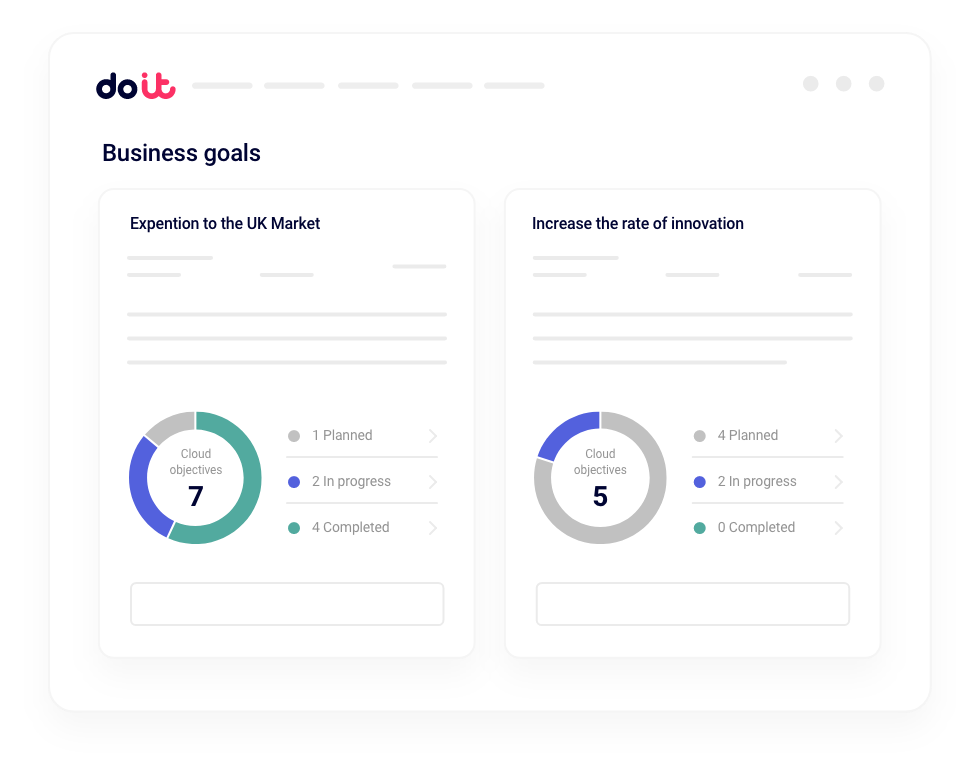

Without proper governance, cloud costs can spiral out of control when organizations can’t identify spending drivers or align costs with their business goals. FinOps takes this challenge and turns it into an opportunity by making cloud financial management a strategic discipline rather than an afterthought. But success still requires a systematic approach beyond simple cost-monitoring tools.

Understanding the need for FinOps in modern finance

The challenge with cloud financial management is that it goes beyond simple cost visibility. Traditional financial processes rely on predictable, straightforward spending patterns, with capacity planning done months ahead of time. Cloud infrastructure, on the other hand, adjusts to real-time demand. This can lead to cost changes that vary month to month, especially for workloads with seasonal traffic patterns.

Several pain points can result from this mismatch. Engineering teams make architectural decisions with limited awareness of financial implications, often choosing solutions that prioritize speed-to-market over more cost-effective solutions. Meanwhile, finance teams struggle to provide accurate budget guidance when they lack visibility into the relationship between business metrics and infrastructure consumption.

Multi-cloud setups add complexity, as each provider has different pricing models and discount structures. A database instance costing $500 monthly on AWS might deliver the same functionality for $350 on Google Cloud, but comparing options creates the need to be familiar with technical specs and regional pricing differences.

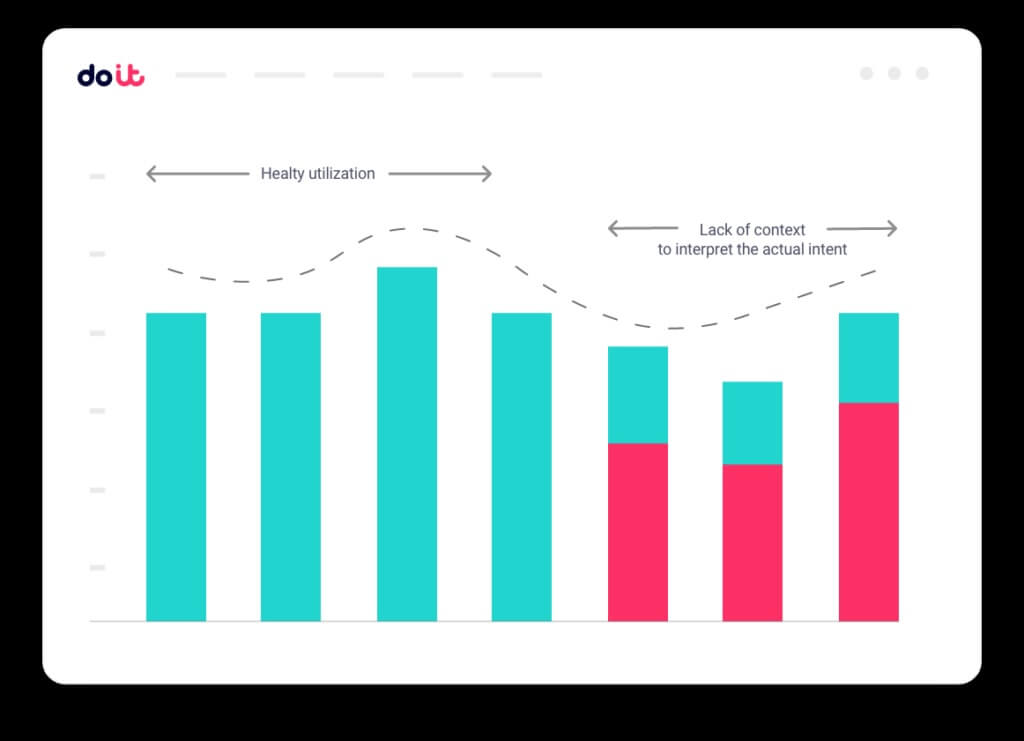

Cloud spending also often includes hidden inefficiencies that appear as “utilized” cloud resources. A Kubernetes cluster showing 80% CPU utilization might seem optimized, but workloads processing data inefficiently due to poor algorithm design could reduce infrastructure requirements by 40%–50% through workload-level optimizations.

Steps to develop and implement a FinOps strategy

Building and rolling out a solid FinOps strategy takes a clear plan to ensure financial accountability and make the most of cloud spending. This section covers the essentials.

Stakeholder engagement and requirements gathering

FinOps works best when engineering, finance, procurement, and business teams all pitch in. Unlike traditional cost management run mostly by finance, FinOps needs technical experts who understand how architecture choices impact costs. Here are some actionable steps to take:

- Define cross-functional ownership. Set up a central FinOps team with members from all departments to choose tools, set policies, and prioritize optimization efforts.

- Establish clear roles. Have your engineering teams handle resource rightsizing and architecture optimization, while finance teams focus on budgets, forecasting, and cost tracking. Business units can then prioritize efforts based on revenue and strategic goals.

- Conduct an organizational readiness assessment. Pinpoint specific challenges FinOps can solve, such as unpredictable cloud bills, poor cost attribution, low engineering cost awareness, and difficulty justifying spending to executives. Talk to engineering teams to gauge their cost awareness and identify barriers to optimization. Many engineers want cost-efficient systems but lack tools, training, or incentives to prioritize them alongside their feature development.

- Assess data and tool maturity. FinOps works best when integrated with existing monitoring, automation, and business intelligence tools. This approach avoids the need for entirely new systems that require additional training and adoption.

- Establish regular alignment meetings. Schedule recurring meetings to maintain momentum. Monthly business reviews should correlate cost trends with business metrics, while weekly optimization reviews can focus on tactical implementation. Create balanced agendas combining strategy and execution, rotate leadership for engagement, and prioritize actionable outcomes over information sharing.

Current state assessment and goal setting

Figure out what your organization’s strengths are across seven areas:

- Cost allocation

- Cost reporting

- Pricing efficiency

- Architectural efficiency

- Training and enablement

- Incentivization

- Accountability

Cost allocation can range from basic departmental tagging to mapping every dollar to specific business outcomes at workload level. Advanced practices link costs to individual applications, customer segments, or revenue streams, providing granular cost insights. For more accurate forecasting, evaluate reporting tools beyond basic dashboards, such as connecting cloud spending to key business metrics like customer acquisition costs, revenue per user, or transaction volumes.

Assess your architectural efficiency with technical expertise to spot optimization opportunities. Take stock of reserved instance usage, spot instance adoption, and autoscaling efforts to identify costs not adding direct business value.

Then, set clear, measurable goals balancing cost efficiency with performance. Align your objectives with business growth rather than arbitrary cost-cutting targets. For example, for 50% user growth, aim to keep cost per user within 10% of current levels while improving application response times by 15%.

Next, establish technical benchmarks. Reserved instance utilization should hit 75% for predictable workloads, spot instances should handle 40%+ of batch and development workloads, and autoscaling should maintain 70%–80% utilization for efficiency and performance.

Finally, define stakeholder accountability. For example, engineering might target 25% storage savings through lifecycle policies, while finance maintains cost forecasts within 5% accuracy, and business units stabilize customer acquisition costs during growth.

Roadmap development and change management strategy

Structure your implementation in three phases (aka the FinOps Framework), each building on the previous one to unlock more advanced capabilities. Start with the crawl phase to establish basic visibility and governance. Then, move on to the walk phase for automated optimization and advanced reporting. Finally, the run phase focuses on predictive cost management and continuous optimization.

- In the crawl phase, focus on laying the groundwork. Set up comprehensive tagging, basic cost alerts, and monthly reporting. This phase usually takes three to six months and sets the stage for everything that follows. Aim for 95% tag compliance across all resources, and implement cost allocation strategies that your business units trust and can easily understand.

- The walk phase is where you bring in automation and optimization tools. Use automated rightsizing, manage reserved instances, and leverage advanced analytics. This is often where the biggest cost savings appear.

- The run phase takes things to the next level by embedding FinOps principles into everyday processes. Cost assessments become part of architectural reviews, and forecasting includes infrastructure scaling models. An optimization mindset then becomes second nature for engineering teams, integrated into their workflows instead of requiring separate efforts.

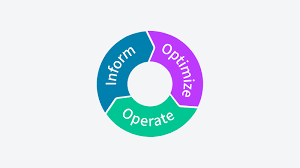

The FinOps Foundation defines three core phases: Inform, Optimize, and Operate. Implement these phases iteratively rather than sequentially, as each phase provides insights that improve the others.

- The Inform phase establishes cost clarity by helping organizations understand where costs come from and how to forecast effectively. Set up tagging strategies that meet both technical and business needs, and build dashboards that connect cost trends with business metrics and usage patterns.

- The Optimize phase focuses on making things more efficient. Use automated rightsizing based on past usage data, cut storage costs with lifecycle policies and smart tiering, and look into enterprise discounts or commitment-based pricing to save more.

- The Operate phase weaves cost optimization into everyday processes. Set up budgets and alerts for spending thresholds, create feedback loops to guide cost-conscious architectural decisions, and schedule regular reviews to keep improving over time.

Create tailored change management plans, as different teams have different FinOps maturity levels. For teams new to cost optimization, start with basics through training on cloud pricing, common savings opportunities, and simple resource selection guidelines. For more cost-savvy teams, focus on advanced tools and integrations, providing APIs and automation options to build optimization into existing workflows rather than expecting uniform adoption rates.

Secure executive buy-in through business case development

Present FinOps as a strategic tool for business growth, not just cutting costs. Use specific examples from your environment to quantify the potential impact.

Industry benchmarks show organizations can reduce cloud costs by 20%–30% annually through optimization. For a $2 million cloud spend, this translates to potential savings of $400,000 to $600,000. However, actual savings and performance improvements depend on your current cloud maturity, existing inefficiencies, and the scope of optimization strategies you implement.

But it’s not just about saving money. Strong FinOps practices bring bigger strategic wins. They help teams launch products faster by providing clear cost guidelines, improving financial forecasting, and helping you stay competitive by keeping costs low in price-sensitive markets.

Engage early-adopter teams for pilot optimization wins

Choose pilot teams that are tech-savvy, open to trying new things, and can show clear cost improvements. High-traffic applications with clear business metrics are great candidates because the results are easy to measure and share with stakeholders.

Focus on quick wins and opportunities with measurable impact during pilots. For example, optimizing reserved instances can cut costs by 30%–50% for predictable workloads in just 30 days. Tweaking autoscaling configurations can reduce overprovisioning costs by 20%–40% while also boosting reliability.

Make sure to document and share the results from these pilots across your organization. Success stories from internal teams tend to resonate more than outside case studies because they address your specific internal challenges and culture.

Establish governance policies and compliance monitoring

Create policies that help guide resource provisioning decisions while keeping your business flexible. Good governance strikes a balance between controlling costs and supporting innovation, acting as guardrails rather than strict rules.

Where possible, automate policy enforcement to save time and reduce errors. For example, use infrastructure-as-code templates to prevent oversized instances in dev environments. Set up cost estimation and approval for any resources that exceed certain thresholds, and automatically shut down unused resources after a set period.

Make sure you have processes in place for legitimate exceptions to the rules. Things like emergency capacity scaling, proof-of-concept projects, or customer-specific compliance needs might require bypassing standard policies, so include approval workflows to handle these cases properly.

Technology implementation and monitoring framework

Choose FinOps tools that work well with your current tech stack and fit your specific needs. To avoid tool overload, focus on platforms that offer multiple features instead of single-use solutions for individual issues.

Set up intent-aware cost monitoring to connect spending with business goals and workload requirements. For example, knowing whether high CPU usage is a sign of efficient resource use or bad application design requires understanding the workload’s purpose, performance goals, and architectural limits.

Use automation to tackle the “illusion of efficiency,” where high resource utilization hides deeper inefficiencies. For instance, a fully utilized GPU inference cluster might still process requests inefficiently due to suboptimal model configurations, meaning it needs workload-level fixes rather than just resizing resources.

Establish metrics that balance cost efficiency with business performance. Cost per transaction, cost per user, and cost per revenue dollar provide better insights than absolute spending levels because they account for business growth and seasonal variations.

Set threshold levels that trigger different responses based on actual spend versus budgeted amounts. Apply these thresholds at multiple organizational levels (total cloud spend, departmental budgets, individual projects, and high-cost services) with variance calculated as (actual spend - budgeted amount) / budgeted amount. For example:

- 10% variance triggers automated alerts to finance teams and department heads for investigation and root cause analysis

- 25% variance requires executive notification and formal remediation plans from responsible department leads within 48 hours

- 50% variance triggers automatic resource scaling restrictions by IT teams until root causes are identified and remediation plans are approved by finance leadership

Basically, create leading indicators that predict cost trends before they impact budgets. Monitoring deployment frequency, new cloud service adoption rates, and traffic growth patterns can help forecast cost changes weeks or months in advance.

Enablement and continuous improvement

Develop role-specific training programs. Engineers need technical training on optimization techniques, automation tools, and cost-aware architecture patterns, while finance teams require training on cloud pricing models, allocation methodologies, and forecasting approaches. Create self-service resources including documentation libraries, FinOps best practice guides, and troubleshooting materials teams can access whenever they need it.

Leverage external partnerships. For example, consider partnering with cloud providers and technology vendors to access training resources, certification paths, and consulting services that can accelerate capability development.

Set up feedback loops to keep improving your FinOps practices. Use monthly reviews to check progress against your KPIs and spot new opportunities for optimization. Additionally, conduct quarterly reviews to reassess strategic goals and make adjustments based on changes in your business.

Keep an eye on both financial and operational metrics to make sure your cost-saving efforts don’t hurt performance or reliability. For example, rightsizing should reduce costs while keeping or even improving application response times, and better reserved instance usage shouldn’t cause capacity issues during peak periods.

Taking the first step often gives you valuable insights to fine-tune your approach. Regularly review your strategy, learn from your experiences, and adjust based on what works best for your organization.

Embracing FinOps as a strategic financial discipline

A FinOps culture takes cloud financial management from simply reacting to costs to actively optimizing value. This journey requires ongoing effort and collaboration across teams, but the benefits are well worth it. With FinOps expertise, teams make smarter, data-driven decisions. Finance teams gain better cost predictability, and business units can scale confidently, knowing their costs are under control.

Success comes from treating FinOps as an ongoing process, not a one-and-done project. Cloud technologies, pricing models, and business requirements change constantly, requiring continuous adaptation and improvement of your cloud cost management practices. Organizations that embrace this continuous evolution position themselves to maximize cloud value while maintaining operational efficiency.

Ready to start the journey in your company? Grab our ebook, which covers everything from how to assess whether you’re ready for FinOps to how to get buy-in from your org.